Term Vs Permanent Life Insurance - Weighing Your Options (5)

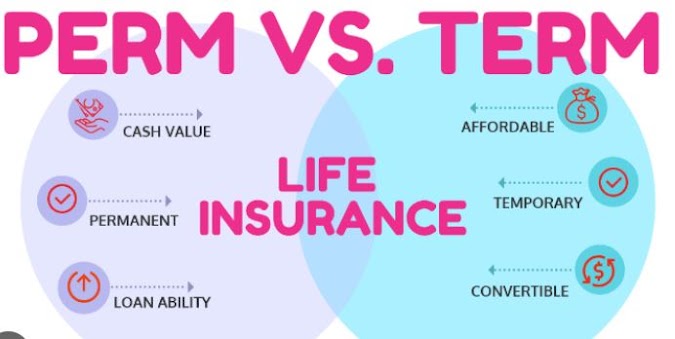

If you are trying to figure out between getting Term or Permanent insurance, this article will discuss the pros and cons of both types of insurance and will help you decide which is the best form of insurance for you.

Benefits of Term Insurance

Term insurance is the most popular form of life insurance that people buy. The reason most people choose to buy term insurance is because term insurance is the most affordable type of insurance coverage. The reason why term life is the most affordable type of insurance is because term insurance does not last forever.

When you buy a term policy, you typically have options for the length of the term coverage that you will have. Options typically include, annual renewable term, 10 year, 15, 20, 25, and 30 year term insurance. The longer term period that you choose, the longer you get to lock in the price and coverage for, and thus the more money the policy will cost you. Most young people should get at least 20 year term coverage.

The other benefit of term insurance is that some insurance companies allow you to convert your term life policy to a permanent insurance policy without evidence of insurability. This can be helpful if you can't afford permanent coverage when you buy a policy, but you want to have that option in the future.

Many people who choose to buy term coverage do that because they want to get more insurance for their money, and believe that their need for life insurance will only last a certain amount of years. For example, some people buy life insurance to protect their family in the years that they have a mortgage payment obligation. If that is the case for you, then buying a 30 year term policy to match your 30 year mortgage might be the best choice. Other people buy term insurance because they want to have life insurance until their kids are able to support themselves. In these cases a 20 or 30 year policy might be the best choice as well.

Permanent Insurance

If you need to have life insurance that lasts your entire life then you are probably looking at permanent life insurance options. What are some reasons why you might need permanent insurance?

If the primary goal of your insurance policy is to leave an inheritance for your children, then you might consider a permanent insurance policy. You might also want to have a permanent policy if you are older than 50 and have a much younger spouse that relies on you for income. If you need to make sure that your spouse will have funds to maintain his/her lifestyle in the future, you should consider a permanent life insurance policy. If you have a special needs child that will forever rely on you for support, a permanent insurance policy would also be the best choice. Lastly, if you need liquidity for estate tax purposes at death, you will also need a permanent insurance policy to ensure that funds will be there to cover estate taxes.

Choosing Between Term and Permanent

If you still aren't sure which is the best way to go for protection for your family, you should compare rates between various types of insurance. Getting an idea of pricing may help you decide which is the best option for you and your family.